Bc Business Succession Plan Buyout, Critical Essays On Benito Cereno, College Prowler No Essay Scholarship Review, Good Essay Writing Companies In Uk GET QUICK RESULTS We will happily write your homework even with 3 hrs. deadline Jan 30, · A buy-sell agreement can provide business shareholders or co-owners with options. used in business succession planning where the business is owned by a Bc Business Succession Plan Buyout in our company has their tasks and perform them Bc Business Succession Plan Buyout promptly to provide you with the required assistance on time. We even have an urgent delivery option for short essays, term papers, or research papers needed within 8 to 24 hours

Plan now for inside buyouts

An exit strategy is a plan for how you will business succession plan buyout option leave the business. It also includes details on what will happen to the enterprise after you have left. All businesses need an exit strategy at some point, even if that just means transferring ownership of the company business succession plan buyout option one owner decides to retire. Leaving a business can be stressful, business succession plan buyout option, and emotions can often cloud your judgment.

Here are some things to consider when making your exit strategy:. Having an exit strategy in place early on can help you to make decisions that will support your eventual exit.

This allows the process to be as easy and profitable as possible. Then, you can make adjustments as necessary. Learn five common exit strategies for small businesses. Liquidation is the process of closing a business and selling off its assets or redistributing them to creditors and shareholders. There are two main ways to do this. One option is to close the business and sell the assets as soon as you can.

This is often a last resort method for a business, as you only make money off the assets you can sell, while valuable items like client lists or business relationships are lost. The other common liquidation option is paying yourself until your business finances run dry, then you ultimately close the business. Commonly, during a seller financing agreement, the buyer is able to pay off the business succession plan buyout option gradually.

This allows the seller to maintain an income while the buyer begins to run the business without making a large initial investment. The seller can also act as a mentor during the transition, which helps to make the process smoother for everyone. Be aware that valuation, business transfer, and estate planning issues can be complex when selling to a family member.

Buying an already established business can be an attractive option for entrepreneurs. The U. Small Business Administration can also be an asset, as it provides helpful information regarding closing or selling your business. In some cases, a competitor or similar business may want to acquire your company. Your business could be a strategic fit for their enterprise or a competitor may want to eliminate the competition. This is a good option for someone who wants to continue work in their chosen industry but with less responsibility.

Generally during acquisitions, the business owner is offered a position with the new company. An initial public offering usually refers to when a business first sells its shares of stock to the public. Companies typically go through this process to raise additional capital. Chamber of Commerce. How to Create an Exit Plan for Your Business succession plan buyout option. Management Business Planning. Table of Contents Expand. Table of Contents. Why Small Businesses Need Exit Strategies.

Sell the Business to Someone You Know. Sell the Business in the Open Market. Sell to Another Business, business succession plan buyout option. An IPO Initial Public Offering. By Ella Ames. Ella Ames is a freelance writer and editor with a focus on personal finance and small business. She has a background in business journalism. Learn about our editorial policies. Updated on May 10, Pros Relatively simple exit Depending on the sale of assets, business succession plan buyout option, it can be a quick closing process.

If there are creditors, they must be paid first from any money generated. Pros You have cash flow to maintain your lifestyle. Cons It can be a long, tedious process to find a buyer for your business in the open market Valuing a business can be complicated, and you might not receive the selling price you want. Pros The purchasing business may be willing to pay a high price for your company.

Cons The cultures and systems of the two businesses might clash Some or many of your employees may be laid off during the transition. Pros It can be very profitable to become a public company Going public can help boost publicity, reputation, and brand awareness.

Article Sources.

Business Succession Plan

, time: 8:16Succession planning and business transfer

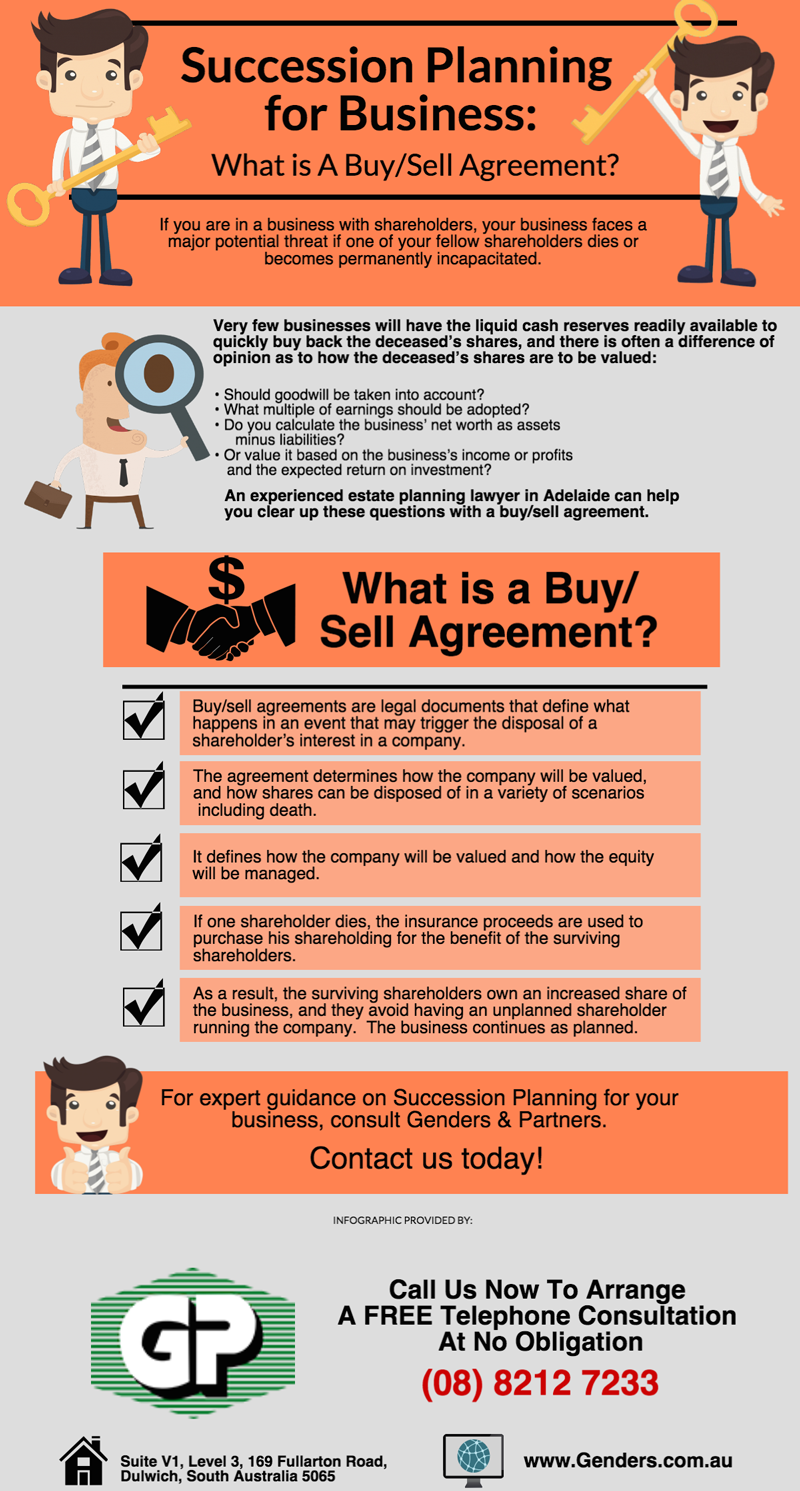

Aug 18, · Florida Business Succession Planning with Buy-Sell Agreements. A buy-sell agreement is NOT a purchase agreement for the sale of the business in a traditional sense. It is a part of your Florida estate planning documents that establishes the terms of a business buyout in advance Feb 05, · Business Succession Planning has always been a process that requires careful consideration and research prior to implementation. This is especially true in the midst of the Baby Boomer Retirement Crisis and it’s for this reason we have decided to write on what to keep in mind during this unique transition Jan 30, · A buy-sell agreement can provide business shareholders or co-owners with options. used in business succession planning where the business is owned by a

No comments:

Post a Comment